Hotline:4001-200-208

Hotline:4001-200-208

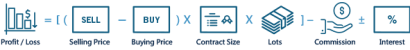

The customer bought 2 lots of GBP/USD, at which the buying price was 1.75050 USD, the margin was 1750.5 USD, the closing price was 1.75100 on the same day, and 2 lots of GBP/USD were closed at 1.75400 USD on the next day. The profit / loss of the customer was :

1.75400 (Selling Price) – 1.75050 (Buying Price) = 0.0035 = 35 (spread)

The following turn the spread into the profit / loss:

35 (Spread) x200,000(contact Size) x 0.0001 (Ticks) = $700 (Profit)

Commission:

50(USD / Lot) X 2 (Lots) =$100(Commission)

Interest:

Swap Long:-3% Swap Short:0%

3% X 1.75050 X 100,000 X 2 X 1 / 360 / 1.75030 =16.6686(Interest)

P/L:

700-100-16.6686=583.3314(Net Profit)